|

|

#21

|

|||

|

|||

|

[ QUOTE ]

[ QUOTE ] [ QUOTE ] I'd rather buy what people like. They might never like your "value" stock. It won't go up if people don't buy it. You can never be sure of what "good value" is anyway. Companies lie all the time. [/ QUOTE ] Yeah, I have to agree with this. If a company is fairly valued or close to reasonably valued and they are likely to have good news in the future they are more likely to go up than companies that are "undervalued". Plus we can be wrong, just as the market can be wrong. [/ QUOTE ] And your evidence for this is? [/ QUOTE ] I thought it was a well known axiom that companies trending upward are more likely to continue trending upward than companies trending down are likely to reverse the trend. Maybe the TA guys can tell us if that is true or not. Here's some stuff I found: MA How to Use Moving Averages Here are just a few simple ideas for putting moving averages to work: 1. Only consider buying a stock if it is above your moving average. By definition, if prices are below the average they are trending down. One of the best pieces of advice I've read on this subject was from Trader Vic. He said When picking stocks, I never buy a stock when prices are below the moving average, and I never (short) sell a stock when price is above the moving average. Just pick up any chart book that uses a 35- or 40-week moving average and you'll see why -- the odds of being right are way against you. Mind you, this is after Vic does all of his fundamental analysis on a stock. So even if the stock looks great fundamentally, he'll pass if it's below the moving average. 2. Use moving averages as an exit signal. Seriously consider selling a stock that closes below the moving average. 3. Consider buying stocks as they drop near an upward sloping moving average. You'll notice when looking at charts that stocks often find support (bounce off of) moving averages. Buying on a pullback to a MA will often give you a good risk/reward entry point. You can put a stop-loss order nearby in case you're wrong about the bounce. That seems to support what I said. |

|

#22

|

|||

|

|||

|

[ QUOTE ]

b) the business's intrinsic value is growing at a strong rate over time, so you will benefit from the growth while you wait for a narrowing of the value gap. [/ QUOTE ] Can you clarify this? I'm not sure I know exactly what you're saying. |

|

#23

|

|||

|

|||

|

[ QUOTE ]

Can you clarify this? [/ QUOTE ] I know you weren't asking me, but I'm hoping DC will chime in also so I'll go ahead and sound off briefly.... Like you believe strongly in Monsanto, I believe strongly that Progressive will continue to take market share over the next couple of decades. So I might be more willing to buy this stock at only a, say, 10% margin of safety, whereas I might require a 30-40% margin of safety on (a low-margin, low-growth business like) Fresh Del Monte, which won't have as high a growth rate. For PGR, I'd buy in expecting to hold on for many, many years and try not to take any capital gains, whereas I'd be aiming to exit FDP as its stock price approaches intrinsic value and go ahead and pay the taxes. Paraphrasing Mr. Buffett, it's better to buy a great business at a good price than a good business at a great price. |

|

#24

|

|||

|

|||

|

[ QUOTE ]

[ QUOTE ] Can you clarify this? [/ QUOTE ] I know you weren't asking me, but I'm hoping DC will chime in also so I'll go ahead and sound off briefly.... Like you believe strongly in Monsanto, I believe strongly that Progressive will continue to take market share over the next couple of decades. So I might be more willing to buy this stock at only a, say, 10% margin of safety, whereas I might require a 30-40% margin of safety on (a low-margin, low-growth business like) Fresh Del Monte, which won't have as high a growth rate. For PGR, I'd buy in expecting to hold on for many, many years and try not to take any capital gains, whereas I'd be aiming to exit FDP as its stock price approaches intrinsic value and go ahead and pay the taxes. Paraphrasing Mr. Buffett, it's better to buy a great business at a good price than a good business at a great price. [/ QUOTE ] I feel like you're calling growth of the business (like revenue growth) growth in intrinsic value. The intrinsic value should account for revenue growth already. Basically what I'm saying is that barring any material changes to the business the intrinsic value should not change. Are we just using different terms here or do you disagree with that? Also, your quote at the end is a Munger quote and "good" is supposed to be "fair". [img]/images/graemlins/grin.gif[/img] |

|

#25

|

|||

|

|||

|

[ QUOTE ]

The biggest issue in value investing is the "realization of value" problem. It may take many years to realize the tremendous value you have discovered that no one else notices yet. DEWY is an electrical contractor supply firm in NJ. They own land well in excess of their market value. It came to my attention in 1996 when it was selling for $1 a share. Land values indicated it shoudl be over $2 a share at that time. It now sells for $3.60 which is still a 50% discount to the value of the land holdings at current prices. DEWY http://finance.yahoo.com/q?s=DEWY.OB [/ QUOTE ] Dan, That stock is up 260% in about 9 years and has absolutely trounced the S&P 500. That is a tremendous return, so I wouldn't use it as an argument against value investing. Anyway, it all depends on how you want to determine value. That is somewhat of an art I'll admit. I wouldn't know how to value a small company like this. |

|

#26

|

|||

|

|||

|

[quote

I feel like you're calling growth of the business (like revenue growth) growth in intrinsic value. The intrinsic value should account for revenue growth already. Basically what I'm saying is that barring any material changes to the business the intrinsic value should not change. Are we just using different terms here or do you disagree with that? [/ QUOTE ] Intrinsic value should grow over time for most businesses. Take a business (ABC corp) that earns $1 per share today, and always earns 15% on capital reinvested in it's business. If it reinvests the $1, then next year earnings should be $1.15. Because of the higher earning power, IV should be 15% higher next year (assuming that the ROE doesn't decline and no other material changes to the business happens). You might think IV for ABC corp is around $15-$20 (15-20 PE) today because you don't think it has any barriers to continued growth for a long time. And lets say it's trading for $10 (10x PE) so you decide to "load up". My point was when it earns $1.15 next year and still trades at a 10x PE, that means it went up 15%, so the growth in IV has compensated you, even though it's discount to IV has remained the same. You would probably be happy owning it for many years even if it stays at a 10 PE, as long as earnings kept growing 15% per year, because effectively your shares will compound at 15% while waiting for that catalyst. You don't need a catalyst to bring it to a 20 PE (though when that happens you will be doubly rewarded). |

|

#27

|

|||

|

|||

|

Okay, I guess we have different definitions of "intrinsic value"?

Intrinsic value, as I'm using the term, is the present value of future cash flows. In determining future cash flows you have to forecast future growth. So that 15% growth next year (and for however many years) will already be accounted for in today's intrinsic value. Basically what I'm saying is that intrinsic value has nothing to do with the price of the stock today. Here is a valuation I did for Monsanto. That, as I understand it, is a calculation of intrinsic value. Is that not the term you'd use for this? |

|

#28

|

|||

|

|||

|

[ QUOTE ]

Okay, I guess we have different definitions of "intrinsic value"? Intrinsic value, as I'm using the term, is the present value of future cash flows. [/ QUOTE ] We have the same definition. The "present value" of future cash flows isn't changing, i.e "present value 2005". But next years value is higher, i.e. "present value 2006". The company will (typically) grow in intrinsic value each year, but it's value discounted back to 2005 stays the same if your projections matched reality. You discount cash flows for one main reason, the time value of waiting to recieve them. As you go one year into the future, you have to wait one less year for those earnings, and you have one more year of earnings reinvested in the business or dividended to you. Example, pretend there is a company called "CashCo". It's going to be in a risk free business for five years, make $1 per share per year, and dividend the total ($5) all to the shareholders on Dec. 25, 2010. You run a dcf on it, and come up with a value around $4 today. Shares are trading at $4.25, so you decide IV is less than price, and so don't buy. But five years from now, on December 1, 2005, you run into a shareholder of CashCo who's frantic. He's getting a $5 payout in 25 days, but needs to buy Xmas presents now. He offers his CashCo share to you for $4.50. Do you say, well I estimated the IV of CashCo and it's only $4? No, that was five years ago. The present day value of cashco is very close to $5 per share, so I hope you take advantage and buy as many shares as possible, that's 10%+ gain in only 25 days. Redo your monsanto analysis with 2006 as the date of purchase. Starting revenues are higher, earning are higher. Why wouldn't you be willing to pay a higher price for Monsanto in 2006 than you would in 2005? Or in 2009, you are walking down the street and a guy hisses from an alley, "hey, got some monsanto for you". Now sales have doubled, earnings are up 250%. It's not worth more to you? Growing companies increase their cash flow, and hence, IV each year. As a shareholder you benefit from that. It helps compensate you when a "value gap" doesn't close. |

|

#29

|

|||

|

|||

|

(Btw, I see that DC has responded to you. I'm posting this before reading what he says, so I won't be biased.)

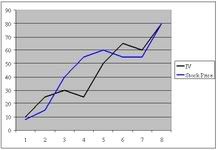

[ QUOTE ] what I'm saying is that barring any material changes to the business the intrinsic value should not change. Are we just using different terms here or do you disagree with that? [/ QUOTE ] I think we disagree. I think businesses' intrinsic values and their stock prices over time behave something like this:  In my mind Progressive is worth $X today, but it will be worth much more than $X in 5 years. When my fellow students and I met with Mr. Buffett a couple of years ago, we pitched him a couple of businesses. As we learned, he had already tried to buy one of them but its owner refused to sell. Mr. Buffett said something like, "That was probably smart of him, because his business will only be worth more with each passing year." [ QUOTE ] Also, your quote at the end is a Munger quote and "good" is supposed to be "fair". [/ QUOTE ] Thanks. |

|

#30

|

|||

|

|||

|

This seems like a pretty sound valuation methodology. If I may be so crass as to offer a couple of unsolicited opinions on some of your inputs....

The cost of equity (8.3%) seems low, but then I never use CAPM. When I do a DCF ....[which I don't always like to do, because a DCF can be like using a telescope to look into space {if you move the telescope half an inch to the left, you end up looking in another galaxy (if you increase your discount to 11%, your IV goes from $124 to $100 (not a galactic shift, but significant))}...I prefer more of a Private Market Value type of valuation based on M&A activity (but of course that's impossible for a company like Monsanto)].... I base my discount rate on a rough "opportunity cost" comparison to the 10 or 30 year govt note (I've been using 10% for the last few years, though I suspect I'll have to bump it up if they keep raising rates). Your ebit margins pre-06 are ~13-14%, but you have 17% going forward. I didn't find a readily apparent reason for the discrepancy, but it's a pretty big issue. If you ratchet EBIT margins down to '05 levels and project that forward, your margin of safety goes from 39% down to 25%. (Plus, I couldn't replicate your pre-06 ebit #s....in 2005, e.g., 6294-3316-1338-601=1039 not 888 (also, the 10K says to me that the #s should be 6294-3290-1334-67-588-7=1008).) The tax rate between now and 2015 seems low, but maybe they have some NOLs or tax credits that I don't know about, and it doesn't change the IV much anyway. The big issue is the growth rate. I mean, I know this market is going to be huge one day. But good freakin' gracious, is it really reasonable to expect that this company will double its revenue over the next 4 years, and then double again in the 4 after that, after its only grown ~4% over the last 4? I mean, wow. That's really fast. |

|

|

|