|

|

#1

|

|||

|

|||

|

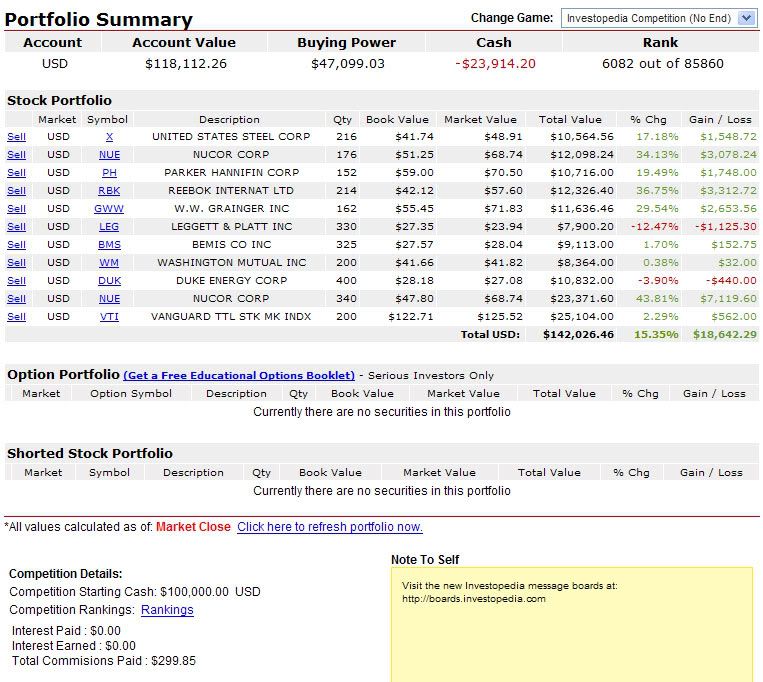

OK I've been trying to learn some about investing. I hope to get into the market with real money at some point but want to be prudnet about how I do that.

I've read "random walk", motley fool basics, know about the PEG, and have read some other stuff online, stingy investor blog (big graham fan)--I have Intelligent Investor and Common stocks-uncommon profits but haven't read either yet. I used a combination of the PEG stat, and some info from the stingy investor blog to put together my screen and came up with the following stuff to put in to my Investopedia profile back in May. I'm sure I'm as big of a fish in this area as I was when I first started poker but was curious as to any feedback on the minimal stuff I have been doing so far. So far mostly its just buy and hold with a couple more buys when things looked even more favorable than they initially had. I also got a littel confused by Investopedia's "cash" and "buying power" numbers so apparently some of this is technically on margin or something?  A knowledgeable friend had said this looked pretty heavy industry heavy however, my screen just didn't yield very many stocks so this is what I came up with. Does it look totally unbalanced. Reading Random Walk taught me a lot so if I were to think about doign anything with real money it would first be wilshire 5000 TMI or somethign like that for a while. My initial thought at htis point is that I'd want to stay may 50% index and max out at 50% individual stocks. Any pointers or advice for me? What do you think of my results so far--am I just a lucky fish or is this the kind of stuff that can be done regularly--obviously I got lucky with the Reebok--Adidas merger but the rest seems like it is jsut the individual companies chugging along--am I missing something? |

|

#2

|

|||

|

|||

|

Why is Nucor listed twice at different "book values"? Is that actually aquisition values?

My one quick comment is that I looked briefly at US Steel in relation to another steel company I'm buy and I was shocked at how cheap it was (it was at a 4 PE). Then I estimated that it basically hadn't made money over the last five years, and it was less surprising. In U.S. Steel's case (and maybe Nucor as well) I'm pretty sure it's benefited in the last few years from import tariffs, and I'm not sure they are still there. That also might be why they are so cheap. You should research that and make a decision on what you think about their business, i.e how much true profit they can make in the future after capital re-investment. I've always been told that steel is a terrible business in general (due to high capital requirements and high U.S. labor costs), and only the exceptions (which might be Nucor, usually viewed as a premium co.) are worth holding. Even they might not be worth holding now if pricing is going down due to tariff changes. What I've been told may be out of date as well, i.e. labor costs may be more reasonable now. |

|

#3

|

|||

|

|||

|

Thanks for the feedback--this gives me some good directions to look into.

Nucor is listed twice at different book values cause i "bought" it thinking it was cheap and then it dropped ten % points so i "bought" more. |

|

#4

|

|||

|

|||

|

Not sure if you knew this, but RBK is in the process of being acquired by Adidas. It'll go for $59 a share. The present discount is based largely on the cost of money over time, so holding RBK right now is a lot like having your money in a money market account.

So you just did a screen and bought whatever came out of the screen, or what? PEG is usually the first number I look at, but there's a lot more to consider. Often when you do screens, the companies with very low PEs and PEGs have reported horrible news that is reflected in the price but not the earnings numbers yet. |

|

#5

|

|||

|

|||

|

So I did a screen using these stats:

1. A member of the S&P500 2. Debt-to-Equity Ratio less than or equal to 0.5 3. Current Ratio of more than 2 4. Interest Coverage of more than 2 5. Some Cash Flow from Operations 6. Some Earnings 7. Price to Sales ratio of less than 1 First I bought absed on that and nothign more which was retarded as the companies where completely without context. Then i learned about the PEG and used it to further screen results of my first screen and see if these companies where actually going anywhere or just happened to wander into a momentarily pretty looking financial picture. I think I loosened the first screen to beyond S+P500 to get more results... |

|

#6

|

|||

|

|||

|

[ QUOTE ]

Not sure if you knew this, but RBK is in the process of being acquired by Adidas. It'll go for $59 a share. The present discount is based largely on the cost of money over time, so holding RBK right now is a lot like having your money in a money market account. [/ QUOTE ] I dont really understand how the merger thing works other than that price of the acquired company usually goes up... and that one day i logged in and it was up 33%... if it was originally a value play then the next question i guess is do i want to own adidas or not...I haven't looked at it yet but figured I would sell it when i got around to it. Is your point that all the big growth potential or potential for the "under-valuedness" to be recognized is gone so take the profits and move on to greener pastures? |

|

#7

|

|||

|

|||

|

[ QUOTE ]

Is your point that all the big growth potential or potential for the "under-valuedness" to be recognized is gone so take the profits and move on to greener pastures? [/ QUOTE ] Yes, assuming aviva is right (I didn't look it up), the point is that the current stock price is pretty close to the buyout price, so your upside potential is limited. Your money would be better served in another stock. Take your profit and move on! |

|

#8

|

|||

|

|||

|

[ QUOTE ]

Is your point that all the big growth potential or potential for the "under-valuedness" to be recognized is gone so take the profits and move on to greener pastures? [/ QUOTE ] Yes. Owners of RBK stocks will receive $59/share when this formally goes through. You already got the big boost. I would sell this as soon as you have something else in mind to buy. [ QUOTE ] 1. A member of the S&P500 2. Debt-to-Equity Ratio less than or equal to 0.5 3. Current Ratio of more than 2 4. Interest Coverage of more than 2 5. Some Cash Flow from Operations 6. Some Earnings 7. Price to Sales ratio of less than 1 [/ QUOTE ] 1. There's really no reason to limit your search to the S&P500. There is a strain of efficient-market theory that says that the bigger and more-analyzed a stock is, the more efficiently it will be priced. Thus, the S&P500 stocks, which are covered by many analysts, are much less likely to represent huge bargains than smaller stocks. I don't agree with it totally. For example, I think WMT is significantly undervalued right now. Certainly you should avoid penny stocks and anything with a market cap under, say, $100 million. Those stocks will be thinly traded and difficult to research. But there are thousands of other mid-cap companies that, IMO, represent your best opportunities. 2&3. The level of acceptable debt varies a lot from industry to industry. Utilities, for example, almost always have a lot of debt. These ratios are factors I would take into consideration, but I wouldn't automatically rule out a company with a low current ratio (e.g. WMT's is 0.83). 4. Do you mean analyst ratings of 2 or better on a scale from 1 to 5? I pay no attention to analysts' opinions. Many of them are still influenced by corrupt investment banking relationships, and in any case analysts are universally too optimistic (less than 2% of stocks have a "sell" rating). Also, stocks tend to get small bumps up or down when analysts change their ratings. If a stock has low or mediocre ratings, it has more room to improve than a stock with a 5.0 rating. 5&6. Yes, absolutely. 7. Similar to your debt screens, the acceptable price/sales ratio varies a lot in different industries. Using a screen of less than 1 will rule out just about any growth-type stock. This part of the screen is probably why you ended up so into heavy industry. Generally, I look for stocks that are leaders in growing industries but are still priced cheaply. When I screen, I look for low PE, high long-term growth, and a strong balance sheet (low debt, positive cash flow). From there, I try to decide whether the market has fully priced in the company's and industry's growth prospects. Some small stocks I like that fit this approach are CREE and PRAA. Both are leaders in industries that I expect to grow very rapidly in the next decade (LEDs and debt collection, respectively), and still have low PEs despite this growth potential. More mature stocks include WMT and MMM. These guys aren't going to grow as fast as the other two, but they're less risky, and they're pretty clearly undervalued. |

|

#9

|

|||

|

|||

|

Wow thats a lot of good stuff...thanks a lot.

For #4 its not analyst opinions--I agree with you on those. Supposedly interest coverage = the ratio of earnings before interest and taxes to interest payments. |

|

#10

|

|||

|

|||

|

I see. Yeah, 2 sounds pretty reasonable. Generally there are better bets than to buy companies having trouble servicing their debt.

|

|

|

|